Let’s talk about arms for a second. Or, rather, let’s talk about a lack of arms. It’s a common thread between Jibo, Kuri and now Astro. I suppose one could make the argument that Anki’s Cozmo had arms of a kind, but the overhead forklift wasn’t good for much beyond hooking into a proprietary block.

Arms — or, rather, mobile manipulators, are hard. They’re a second-generation problem. Or maybe a third or fourth. Once you’ve proven out that enough people are interested in your new little home robot, then you can have those frank discussions about how much R&D you want to dump into a pair of arms that can dust the counter and make sure your magazines are in an orderly pile without breaking down every two days. Maybe arms are when you start scanning the periphery for possible startup acquisitions.

To hear Amazon talk about it, Astro was created without the aid of acquiring any specific companies. A lot of “ground up” development was required for what has thus far been a four-year project, most notably, the in-house development of a SLAM (simultaneous localization and mapping) system, so the robot knows where it is and where it’s going. And while the department worked with Amazon Robotics, the company’s industrial automation wing born out of its 2012 purchase of Kiva Systems, on-board technology from its autonomous cart system Canvas apparently didn’t factor in.

Image Credits: Bryce Durbin/TechCrunch

Don’t forget to sign up to get the upcoming free newsletter version of Actuator delivered to your inbox.

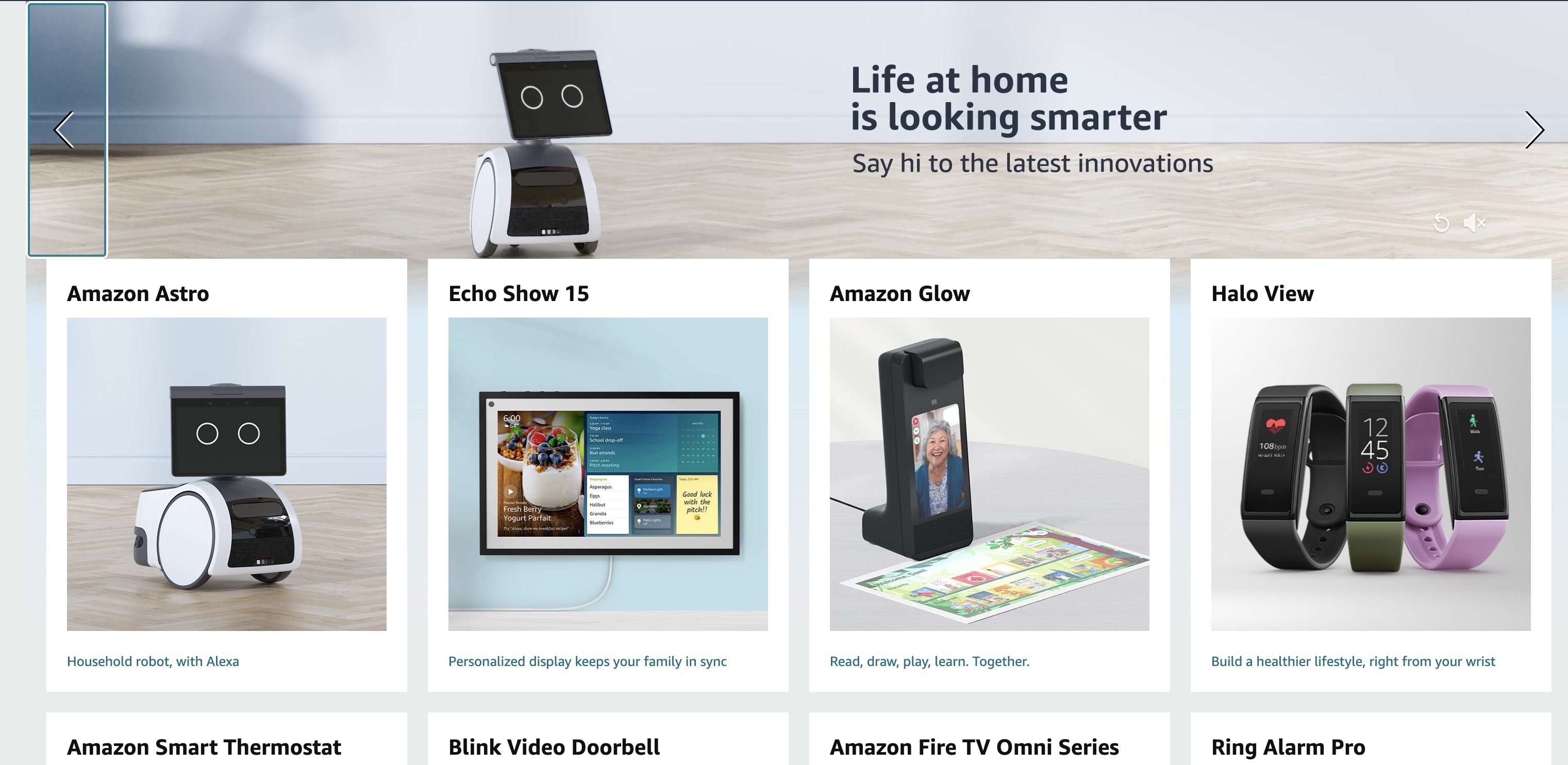

Credit to the person on Twitter who compared Astro’s look to a tablet mounted on a vacuum canister. We had, um, a lot of feedback on the site, but that was one of the more amusing comments and I think it — perhaps unintentionally — gets to something deeper about the $1,000/$1,500 robot. Astro exists at this kind of perfect nexus of Amazon hardware efforts, from Ring security to Echo Show.

Yesterday’s common refrain of “Alexa on wheels” isn’t entirely off-base. Astro is a kind of baby step into a world of more ubiquitous home robotics. There’s a consensus among many that we’ll get there in five, 10 or 15 years, but the most immediate question is how we get there — which is to say, what are the immediate stepping stones? For iRobot, it’s leveraging the home mapping of robotic vacuums and using that in tandem with home assistants like Alexa or Google. For Amazon, Alexa is that foundation.

Image Credits: Brian Heater

These are both fairly solid foundations from the standpoint of relative ubiquity. Pulling from some third-party research from last year, around a quarter of U.S. adults live with a smart speaker, and of those, almost 70% use Alexa. But even with numbers like that, the jump from Echo to Astro is still a big one. But credit to Amazon for giving it a go, even if its track record has made many consumers understandably weary of the messenger.

I spent a little time with Astro last week ahead of the launch and was impressed by what Amazon put together here. I wasn’t $1,500 worth of impressed. Pricing is going to be a pretty big hump to get over here (all of the caveats about that eventually coming down if Amazon can scale it), but the built quality is high and Astro is a clever combination of existing Amazon product lines, a few years of hard work and some clever workarounds like the periscope camera that pops out of the robot’s head.

Ad, Astro

There are questions swirling around whether a $1,500 robot can ever be a mainstream product from a company that trades in consumer electronics commodities (hell, I ask one below), but there’s a sense in which that is almost besides the point. It seems extremely unlikely that there will be an Astro in every home, but it does mean that Amazon is able to plant a flag here. Sure Samsung shows off a bunch of helper robots each year at CES, but until proven otherwise, they amount to little more than hypotheticals.

With Astro, Amazon announced a robot that’s going on sale soon — price prohibitive and invite-only as it may be. There’s a sense in which that’s a win in and of itself. Certainly Amazon hardware ambitions won’t live or die by the Astro’s success. Once they begin rolling out, the company could potentially have access to the largest wide scale home robotics trial for anything without a vacuum attached.

As Amazon Device VP Charlie Tritschler notes in our conversation below, Astro finds the company taking the first step toward a broader world of home robotics. Ultimately, Amazon’s consumer robotics might not look like Astro at all.

Let’s start with the ‘why.’ Why is this something Amazon is actively pursuing?

Given the fact that Amazon is always focused on customer experience, one of the things we look at is what are the upcoming technologies that can impact what’s available? In a senior meeting a few years ago, we were talking about just that. We talked about AI, computer vision, processing power. One of the topics that came up was robotics. How have robotics changed to make it possible now for consumers. We have a lot of experience using robotics in our fulfillment centers, of course, and we thought about what can we do to make robotics in the home more convenient for consumers or provide peace of mind as part of the experience. That started us thinking about it, and by the end, we were saying, ‘does anyone in the room think that we won’t have robots in the home in five to 10 years?’ And everyone said, ‘yeah, we will.’

Obviously there are already Roombas in a lot of homes, but those are robots that do one very specific thing. I assume you began by looking beyond that application?

The three big things that we saw ourselves that were confirmed with our beta testers were home monitoring — that’s both security and the ability to check in on the home remotely. The second is the ability to care for loved ones, especially when they’re remote and you can’t care for them all the time. And the third was Alexa: being able to take Alexa and being able to add intelligent mobility to give it new capabilities around the home.

Image Credits: Brian Heater

How much of the robot was built from scratch?

Tough to give you a specific number, but the vast majority of it. We learned a lot, especially early on in the program, from other parts of the company. We already had robotics experience, like Amazon Robotics, who primarily focus on the fulfillment center and are looking at efficiency and making jobs easier. But we recognized as we started doing the work that to conquer the domain that is is the home — every home is different, every home changes all the time, as people move things around, put things down, drop a chair on the floor, put a backpack somewhere. So the team started looking at that and we realized we had to create our own SLAM experience.

Nothing on the robot was the direct result of an acquisition?

Yeah.

It struck me that Amazon’s purchase of Canvas would make sense from the standpoint of creating this fully autonomous [robot].

If there’s tools that make sense — if there’s a simulation tool or other pieces, of course we will take advantage of those internal capabilities wherever possible, but the unique demands of creating a robot for the home means that we really did have to do a lot of invention to create the solution for consumers.

Image Credits: Brian Heater

What were the biggest challenges in developing Astro?

Where can I start? One of the topics is just figuring out how do you conquer the technical problems. There were just so many places where we really needed to invent and create, which is hard to predict. You have to go in and start the work. We had many places during the development where we would go down a path, stop, come back, start, rethink and redo. So the overall complexity of the experience from a development perspective and all of the interdependencies between different systems were some of the biggest areas we had to overcome.

What has the primary failing of home robotics been to this point?

I don’t think it’s failings. I think it’s just that we’ve taken a slightly different approach, which is we focused on what the end value is that we’re trying to create. And then we brought to bear all of the learnings that we have as Amazon with our robotics abilities and then applied all of our Amazon assets as well, like Alexa, Ring, Alexa Care or Amazon Kids.

At what point was it clear this is something you could/should bring to market?

We had the vision of it early on, but I think for me it was the very first time I saw it actually navigate a room by itself. Up until then, we thought we could do it. We’re smart people, we’re working on it. But to see it actually happen and move gracefully and avoid obstacles, when you place something in front of it. I knew that some of the core things that had to be true to make this work were achievable.

Image Credits: Amazon

Were there any major failings in the testing process that caused you to circle back?

There were[…] SLAM, for instance, took a long time to get to the point where we could get it working well enough. People would say, ‘it stopped in the corner. I don’t know why, but it went over there and stopped.’ SLAM had some issues.

Do you anticipate the pricing will remain the same when Astro is available in a more mainstream way?

Hard to know. I think that’s part of what we’ll hear from customers. Obviously, Amazon has a history of trying to provide more value to customers over time, and as the whole space of robotics and sensors come down, we will pass that onto the customer.

You had the conversation four years ago when you said robotics would be mainstream in five to 10 years. We’re pushing right up against that deadline. Do you envision Astro as a mainstream product or a stepping stone?

I think it’s the first of the robot series that we’re doing. That’s why it’s an invite-only program. We want to make sure that people that get Astro have a great experience with it, given the challenges of homes and different spaces. We think long-term when we think of consumer robotics. We want to have all different kinds of price points and capabilities and have a more directed mainstream product as part of that.

Image Credits: Amazon

All right, I think that’s probably enough words about Amazon’s $1,500 home robot for now — at least until we spend some more time with the product, which will hopefully be in reasonably short order.

So we go out of the home and into the field for a pair of agtech raises. The first one, from Iron Ox, just missed the deadline for last week’s roundup, but it’s an interesting company doing interesting things in agtech that are worth mentioning here. The Bay Area firm isn’t strictly a robotics company, but the technology does play a big role in what it does.

Image Credits: Iron Ox

Effectively, the company runs a robotic greenhouse as a “closed loop system” designed to grow produce with a significantly smaller environmental footprint than traditional farming — including a 90% reduction in water. Iron Ox just announced a $53 million Series C, which will go toward ramping up manufacturing, R&D and making a bunch of new hires.

Burro, meanwhile, is a company that first hit my radar as Augean Robotics. The company participated in a TechCrunch pitch-off ahead of our 2020 Robotics event. Always cool to see a startup level-up like that. This week it announced a $10.9 million raise for its autonomous cart system, which is designed to relieve the burden of carrying crops for overworked field hands.

Image Credits: Burro

The technology, which Burro calls “pop-up autonomy,” makes a lot of sense in a world where there were labor constraints even prior to the pandemic. The company currently has around 90 robots in the field, which plans to expand to more than 500 next year.

Looping back around to a very different set of robotic arms, GrayMatter this week announced a $4.1 million seed round, co-led by Stage Venture Partners and Calibrate Ventures and featuring 3M Ventures, OCA Ventures, Pathbreaker Ventures and B Capital Group. Founded in 2020, the company leverages robotic systems to help manufacturers finish surfaces.

“It is shocking that millions of people still manually work on extremely tedious tasks that can be harmful to their health; younger generations do not want such jobs,” CEO Ariyan Kabir said in a release. “We want to improve shop workers’ lives, enhance their productivity, and enable them to focus on higher-value tasks. Manufacturing drives our economy, and without automating surface finishing and treatment, there is a significant risk the global economy may suffer due to an increasing labor shortage.”

Meanwhile, Sarcos, which announced its SPAC plans back in April, began trading on Nasdaq this week under the symbol STRC. The company, which specializes in exoskeletons and robotics to aid industrial workers, says it plans to use the SPAC money to help bring its first systems to market by the end of next year.

But be assured, between a lack of arms, an inability to climb stairs and the above, I’d say we’re not under any risk of full-scale home robotic uprising any time soon soon.

Source Link Ad Astro

Leave a Reply