Loop Health aims to be the “Oscar Health of India” and targets the country’s health insurance gap with its approach to primary care and insurance.

The Pune-based company is also the latest startup to raise funding in this area, bringing in $12 million in Series A funding in a round co-led by Elevation Capital and General Catalyst. Joining the two firms is Vinod Khosla, through Khosla Ventures, YC Continuity Fund, Tribe Capital and a group of angel investors, including NoBroker founder and CEO Amit Kumar Agarwal, Livspace founder and COO Ramakant Sharma, Meesho co-founders Vidit Aatrey and Sanjeev Barnwal, Carbon Health co-founder and CEO Eren Bali, Codecademy co-founder and CEO Zach Sims and Maven Clinic founder and CEO Kate Ryder.

The new funding gives Loop Health a total of $14 million in funding since it was founded in 2018, Mayank Kale, co-founder and CEO, told TechCrunch. This includes a previous $2.3 million seed raise. The company was part of Y Combinator’s Winter 2020 accelerator program.

Kale, who was previously building digital patient health records across India, started the company with Ryan Singh, Amrit Singh, and Shami Raj to provide group health insurance plans from large insurers to companies of all sizes that includes a virtual primary care experience through Loop Health’s in-house medical team and network of service providers.

It is estimated that fewer than 15% of people in India have purchased healthcare insurance, and of those who have it, most plans only work on hospitalizations and medical procedures, Kale said. Loop Health aims to change that by providing ongoing care so that a person shouldn’t have to go into the hospital unless necessary.

“In talking to potential customers, half of them are buying insurance for the first time,” Kale added. “Now employees are asking for it so that the company is competitive with others providing the benefit, but then COVID made it one of the central benefits to people. The sentiment has flipped now.”

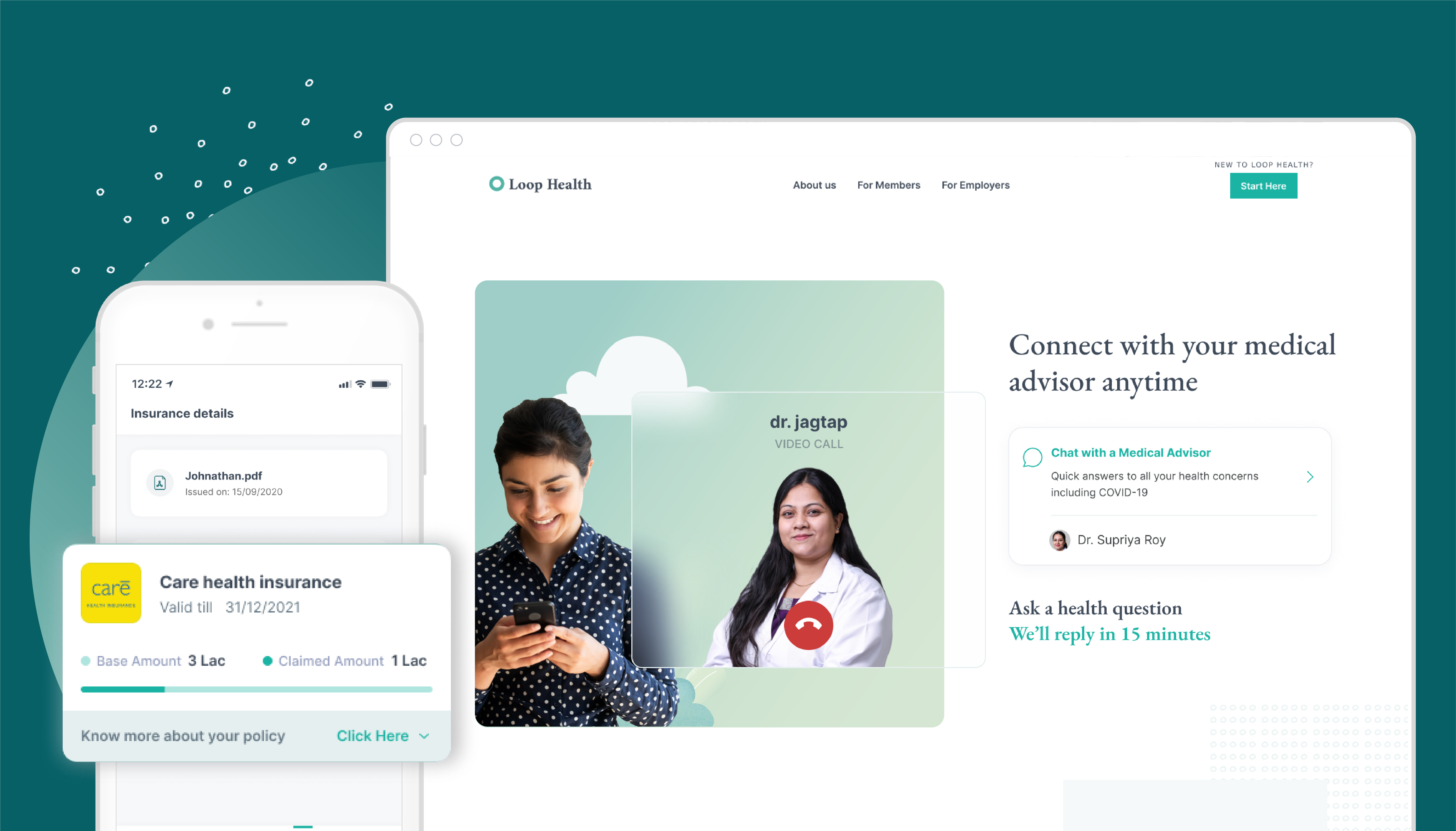

Loop Health app. Image Credits: Loop Health

Legacy insurance plans don’t typically provide coverage for most diseases for up to four years after purchasing it, but with Loop Health, 40% of Loop’s customers consult a Loop doctor in the first three months on the plan, Kale said.

Over the past 12 months, the company has begun working with over 150 companies that represent about 50,000 total members, including Shaadi.com, rediff.com, Helpshift, Knorr-Bremse, Shoptimize, Weikfield and Moonshine Meadery. Loop Health has a target to cover 1 million members by the end of 2022 and 5 million members across Southeast Asia over the next five years.

At the same time, the company has grown 50% month over month in revenue and went from 10 employees to about 80 operating in Pune, Mumbai and Bengaluru. That includes 15 care specialists, Kale said.

To keep the momentum going, he intends to use the new round of capital to onboard more members, build physical healthcare clinics, hire in sales, engineering and product development.

“We will keep growing quickly and are on track to onboard a couple hundred more companies over the next 18 months,” Kale said. “We are optimizing for trust. We want to be the trusted healthcare provider, and we will do that by providing a health concierge that responds to calls in 50 seconds, provides same-day consultations, personalized care plans for chronic disease and financial cover when patients need it.”

In addition to Loop Health, other startups are addressing health insurance in India. For example, this investment follows a seed round that Khosla Ventures made into healthcare membership startup Even. Meanwhile, Tiger Global led a $15.6 million Series A round into Plum, a startup enabling employers to provide insurance coverage to their employees, and Policybazaar raised $75 million this year for its insurance marketplace.

Mayank Khanduja, partner at Elevation Capital, considers Loop Health primarily a healthcare company that also provides insurance. Insurance is difficult to figure out, and many policyholders are even unsure of which hospital to even go to, he said.

He estimates the market to be valued at $3.5 billion and growing annually at 20% to 25%. It is a deep enough pool for someone like Loop Health to attack it and grow fast, especially with the push by employees driven by COVID.

“This was missing in India,” Khanduja added. “Insurance is sold in India as a commodity product — something to keep in the drawer to hold and hope you don’t have to use it. That is what is exciting to us about Loop Health. They are providing corporate insurance, but then also a full suite of primary care intervention, which will hopefully take care of you to where you don’t need hospitalization.”

Source Link Elevation Capital, General Catalyst lead $12M round into health insurance startup Loop Health

Leave a Reply