China is becoming a superpower in the tech industry. According to Straits Times, China is the only place in the world where it takes less than six years for a startup to become a unicorn — it takes seven years in the U.S., eight years in the U.K. and 11 years in Germany. Despite geopolitical tensions and recent amendments in CFIUS, it is hard to ignore China.

When I joined Runa Capital almost a year ago, my task was to help our portfolio companies enter the Chinese market, find the right partners and raise funding from Chinese investors. And almost on every call with our startups, colleagues from Runa or other global VCs, I heard: Is it a good idea to raise from a Chinese VC? Is it OK to co-invest with Chinese investors? I was surprised to learn that there is little research answering such question, as there is a lack of adequate information in English about Chinese investments.

Access to the Chinese market seems to be an obvious reason to invite Chinese funds aboard, but only about 20% of Western startups with Chinese capital have operations in China.

So as a Mandarin-speaking specialist, I decided to fill this gap by conducting a study based on a Chinese VC database ITjuzi (the Chinese version of Crunchbase) with the help of our powerful data science resources developed by Danil Okhlopkov.

Below, I will try to answer the following questions using statistics and a case-based approach:

- How much do Chinese funds invest abroad?

- What is the current trend?

- Can Chinese investors bring any value to Western startups?

- Who are the most active Chinese investors abroad?

- In which areas can Chinese funds bring the most value?

- What value can Chinese investors bring?

- When is it better to invite a Chinese investor?

Chinese investors are interested in Western startups

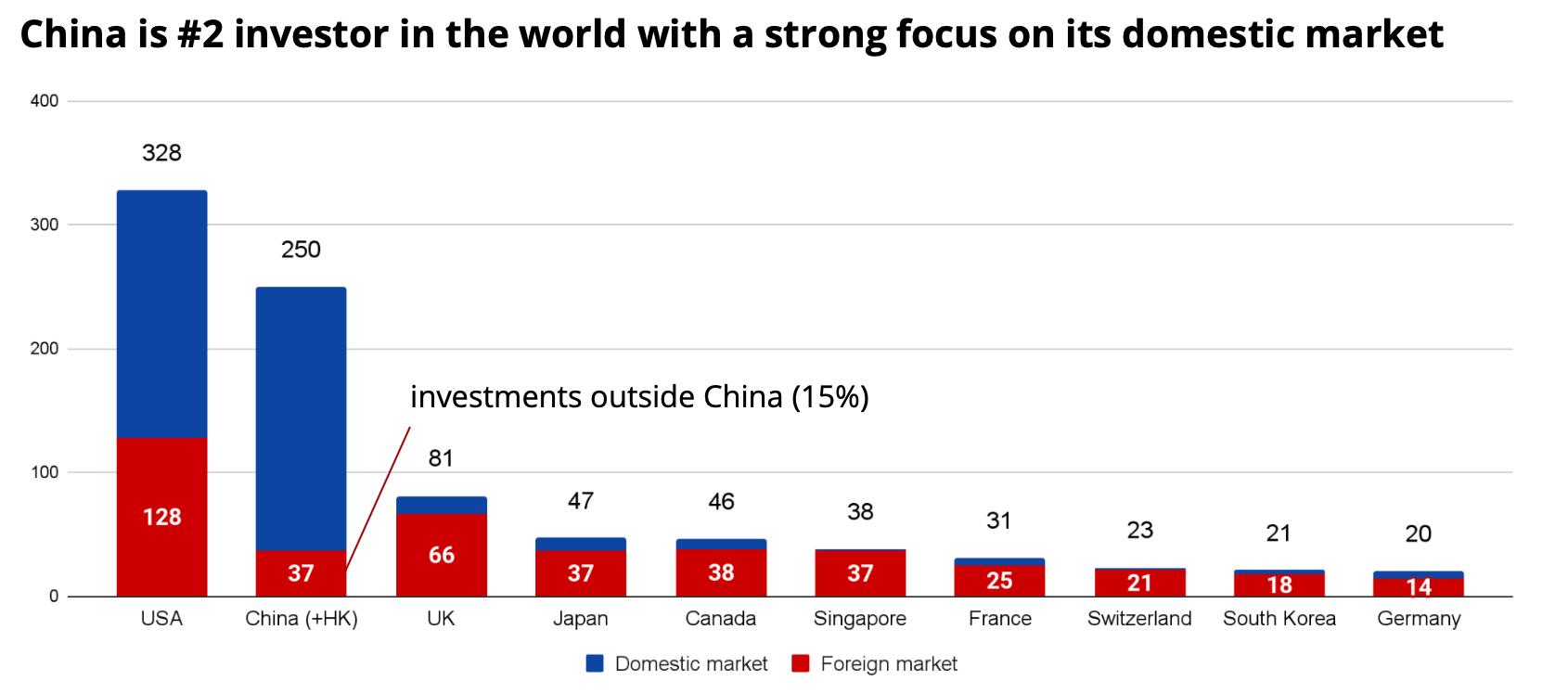

After studying data from ITjuzi, we estimated that Chinese funds invested around $250 billion in 2020 (three times higher than the figure in Crunchbase). This figure puts Chinese VC investments only 30% lower than investments by U.S. funds, but three times that of U.K. funds, 12.5 times more than German funds.

Fig. 1 – Comparison of investment from different countries in 2020, $bn. Source: Crunchbase, ITjuzi. Image Credits: Denis Kalinin

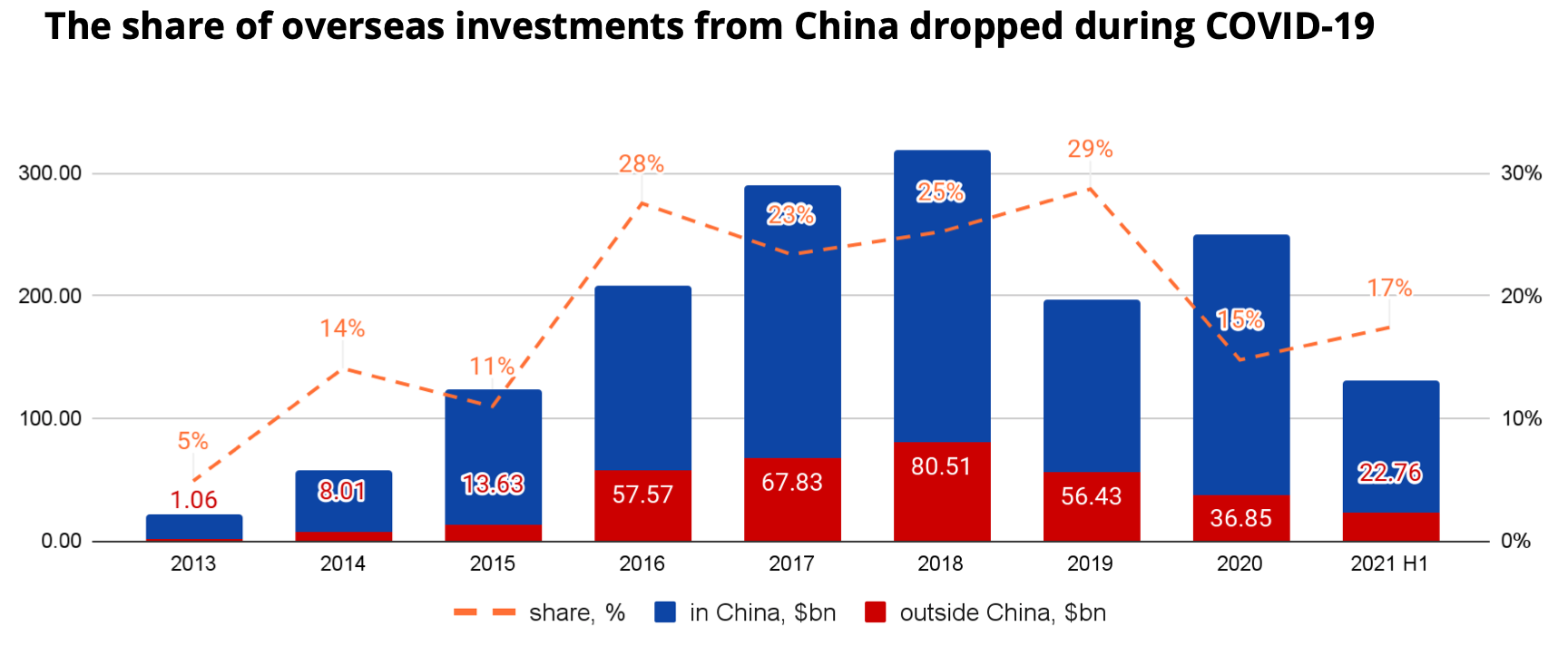

However, only 15% of investments in 2020, and 17% of investments in the first half of 2021 were in companies outside China, significantly lower than in 2019. This appears to be because during COVID, China’s economy recovered much faster than other countries’, so many Chinese investors preferred to redirect their capital flows to the domestic market.

On the other hand, there is great potential for overseas investments to rebound as soon as the borders reopen and the global economy starts to recover.

Fig. 2 – Dynamics of Chinese investments. $bn. Source: Crunchbase, ITjuzi. Image Credits: Denis Kalinin

We can also see that Chinese investors are eyeing European startups favorably, which is related to U.S.-China geopolitical tensions as well as the fact that the European VC market is becoming mature.

Source Link Is it so bad to take money from Chinese venture funds?

Leave a Reply