After digging into the Rent the Runway IPO filing this morning, we’re turning to Udemy.

The Udemy offering comes in the wake of the successful Duolingo IPO earlier this year. And the company’s debut may prove to be the final major edtech IPO ahead of Byju’s eventual debut — how well Udemy performs in its public offering could impact others in its market, including some incredibly wealthy education technology players.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

So, how does the company’s growth profile appear after the pandemic-powered wave of demand for edtech has passed?

In the case of Udemy, we’re looking at an online learning service that raised north of $300 million while private. A $50 million Series F raised in late 2020 valued the company at a touch over $3.2 billion, per Crunchbase data.

For Lightbank, Insight Partners, Norwest Venture Partners, Mindrock Capital and Tencent, the company’s IPO is a material liquidity event; there’s lots of capital riding on its success.

The edtech company is an interesting two-part business, with one piece of its operations aimed at consumers and the second at businesses. To understand how healthy Udemy is or is not, we’ll have to dig into each half of its business model — we’ll also want to know what’s happening to the company’s aggregate revenue mix and which direction it’s leaning in recent quarters.

The edtech company is an interesting two-part business, with one piece of its operations aimed at consumers and the second at businesses. To understand how healthy Udemy is or is not, we’ll have to dig into each half of its business model — we’ll also want to know what’s happening to the company’s aggregate revenue mix and which direction it’s leaning in recent quarters.

Sound like fun? I’m super stoked to get into this one. So, let’s:

Udemy’s business through the pandemic

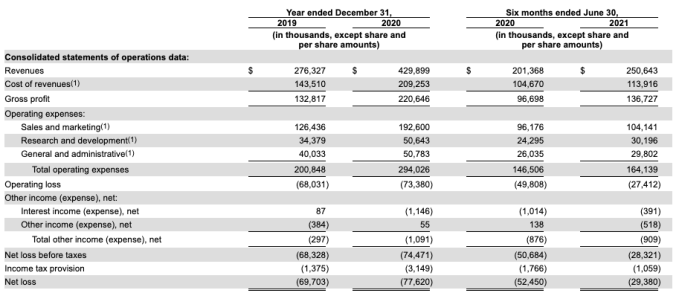

From 2019 to 2020, Udemy grew from $276.3 million in revenue to $429.9 million, or 55.6%. That’s quite a lot for a company that has already reached material scale, or revenues of $100 million and above. More recently, in the first half of 2021, Udemy posted $250.6 million in total revenues, up 24.5% compared to H1 2020.

But we expected Udemy to grow more slowly after its pandemic bump, frankly, so to see the company’s revenue growth decline into 2021 is not a huge shock. How investors value a slower-growing — but larger and more profitable — edtech company will be interesting to watch.

Not that Udemy actually makes money. It does not. But it is losing less money over time:

Image Credits: Udemy S-1

If you want to get a net income number excluding the cost of share-based compensation, you can deduct $20.6 million from its H1 2020 number and $16.5 million from its H1 2021 figure. The latter calculation will get you down to less than $13 million in losses during the first half of 2021 at Udemy. That’s far closer to profitability than the company has managed in prior periods, indicating that Udemy enjoyed some operating leverage during the pandemic, cutting losses while its revenues expanded.

Revenue mix

We’re going to break our general rule of not including marketing-friendly charts in our S-1 teardowns for the following exception:

Source Link Udemy files to go public on back of growing B2B incomes

Leave a Reply