There’s an old startup adage that goes: Cash is king. I’m not sure that is true anymore.

In today’s cash rich environment, options are more valuable than cash. Founders have many guides on how to raise money, but not enough has been written about how to protect your startup’s option pool. As a founder, recruiting talent is the most important factor for success. In turn, managing your option pool may be the most effective action you can take to ensure you can recruit and retain talent.

That said, managing your option pool is no easy task. However, with some foresight and planning, it’s possible to take advantage of certain tools at your disposal and avoid common pitfalls.

In this piece, I’ll cover:

- The mechanics of the option pool over multiple funding rounds.

- Common pitfalls that trip up founders along the way.

- What you can do to protect your option pool or to correct course if you made mistakes early on.

A minicase study on option pool mechanics

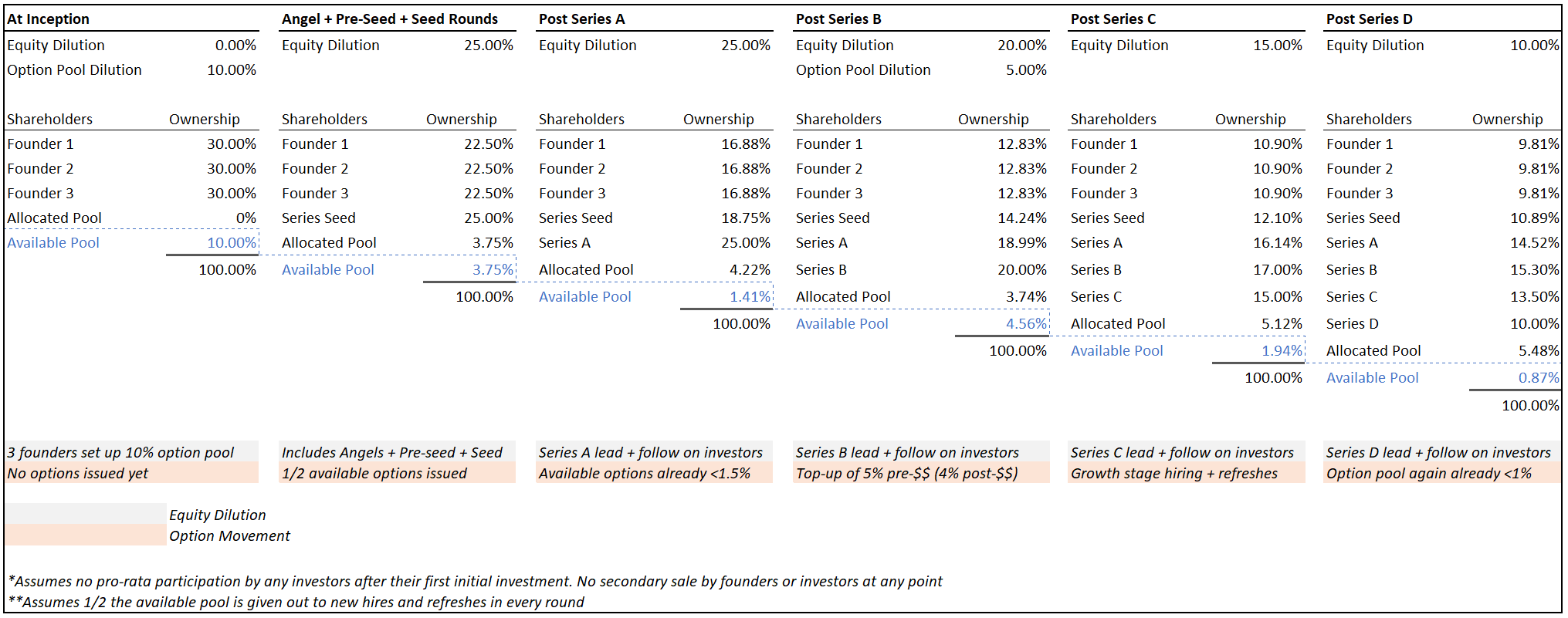

Let’s run through a quick case study that sets the stage before we dive deeper. In this example, there are three equal co-founders who decide to quit their jobs to become startup founders.

Since they know they need to hire talent, the trio gets going with a 10% option pool at inception. They then cobble together enough money across angel, pre-seed and seed rounds (with 25% cumulative dilution across those rounds) to achieve product-market fit (PMF). With PMF in the bag, they raise a Series A, which results in a further 25% dilution.

The easiest way to ensure you don’t run out of options too quickly is simply to start with a bigger pool.

After hiring a few C-suite executives, they are now running low on options. So at the Series B, the company does a 5% option pool top-up pre-money — in addition to giving up 20% in equity related to the new cash injection. When the Series C and D rounds come by with dilutions of 15% and 10%, the company has hit its stride and has an imminent IPO in the works. Success!

For simplicity, I will assume a few things that don’t normally happen but will make illustrating the math here a bit easier:

- No investor participates in their pro-rata after their initial investment.

- Half the available pool is issued to new hires and/or used for refreshes every round.

Obviously, every situation is unique and your mileage may vary. But this is a close enough proxy to what happens to a lot of startups in practice. Here is what the available option pool will look like over time across rounds:

Image Credits: Allen Miller

Note how quickly the pool thins out — especially early on. In the beginning, 10% sounds like a lot, but it’s hard to make the first few hires when you have nothing to show the world and no cash to pay salaries. In addition, early rounds don’t just dilute your equity as a founder, they dilute everyone’s — including your option pool (both allocated and unallocated). By the time the company raises its Series B, the available pool is already less than 1.5%.

Source Link A founder’s guide to effectively managing your options pool

Leave a Reply