Southeast Asian tech companies are drawing the attention of investors around the world. In 2020, startups in the region raised over $8.2 billion, about four times more than they did in 2015. This trend continued in 2021, with regional M&A hitting a record high of $124.8 billion in the first half of 2021, up 83% from a year earlier.

This begs the question: Who exactly is investing in Southeast Asia?

Let’s explore the three key types of investors pouring money into and driving the growth of Southeast Asia’s tech ecosystem.

Over 229 family offices have been registered in Singapore since 2020, with total assets under management of an estimated $20 billion.

Big tech

Southeast Asia has become an attractive market for U.S. and Chinese tech firms. Internet penetration here stands at 70%, higher than the global average, and digital adoption in the region remains nascent — it wasn’t until the pandemic that adoption of digital services such as e-wallets and online shopping took off.

China’s tech giants Tencent and Alibaba were among the first to support early e-commerce growth in Southeast Asia with investments in Sea Limited and Lazada, and have since expanded their footprint into other internet verticals. Alibaba has backed Akulaku, M-Pay (eMonkey), DANA, Wave Money and Mynt (GCash), while Tencent has invested in Voyager Innovations (PayMaya), SHAREit, iflix, Ookbee and Sanook.

U.S. tech firms have also recently entered the scene. In June 2020, Gojek closed a $3 billion Series F round from Google, Facebook, Tencent and Visa. Google, together with Singapore’s Temasek Holdings, invested some $350 million in Tokopedia in October. Meanwhile, Microsoft invested an undisclosed amount in Grab in 2018 and has invested $100 million in Indonesian e-commerce firm Bukalapak.

Venture capitalists

In Q1 2021, Southeast Asian startups raised $6 billion, according to DealStreetAsia, positioning 2021 as another record year for VC investment in the region.

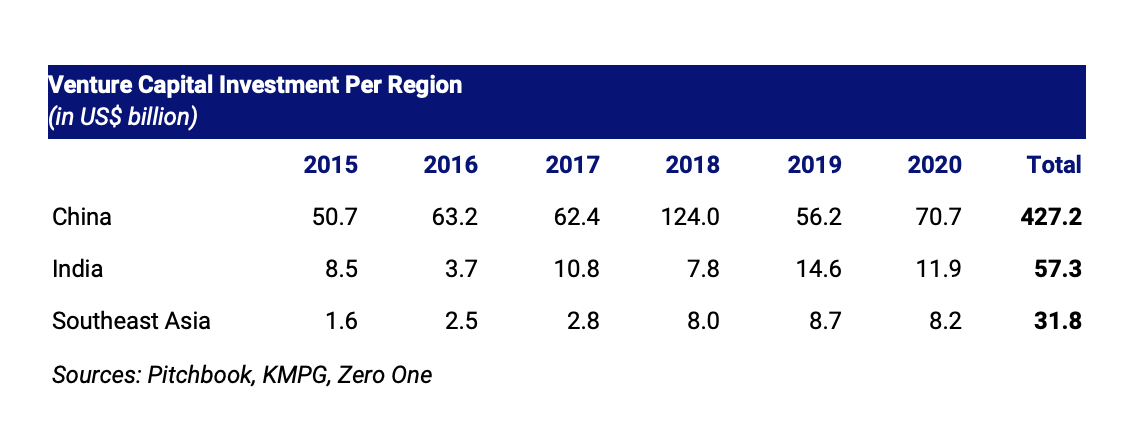

The region is also rising in prominence as a destination for investment capital relative to the rest of Asia. Regional VC investment grew 5.2 times to $8.2 billion in 2020 from $1.6 billion in 2015, as we can see in the table below.

Image Credits: Jungle VC

Southeast Asia also has many opportunities for VC investment relative to its market size. From 2015 to 2020, China saw VC investment of nearly $300 per person; for Southeast Asia — despite a recent investment boom — this metric sits at just $47.50 per person, or just a sixth of that in China. This implies a substantial opportunity for investments to develop the region’s digital economy.

The region’s rising population and growth prospects are higher due to China’s population growth challenges, alongside the latter’s higher digital economy market saturation and maturity.

Source Link Investors are doubling down on Southeast Asia’s digital economy

Leave a Reply